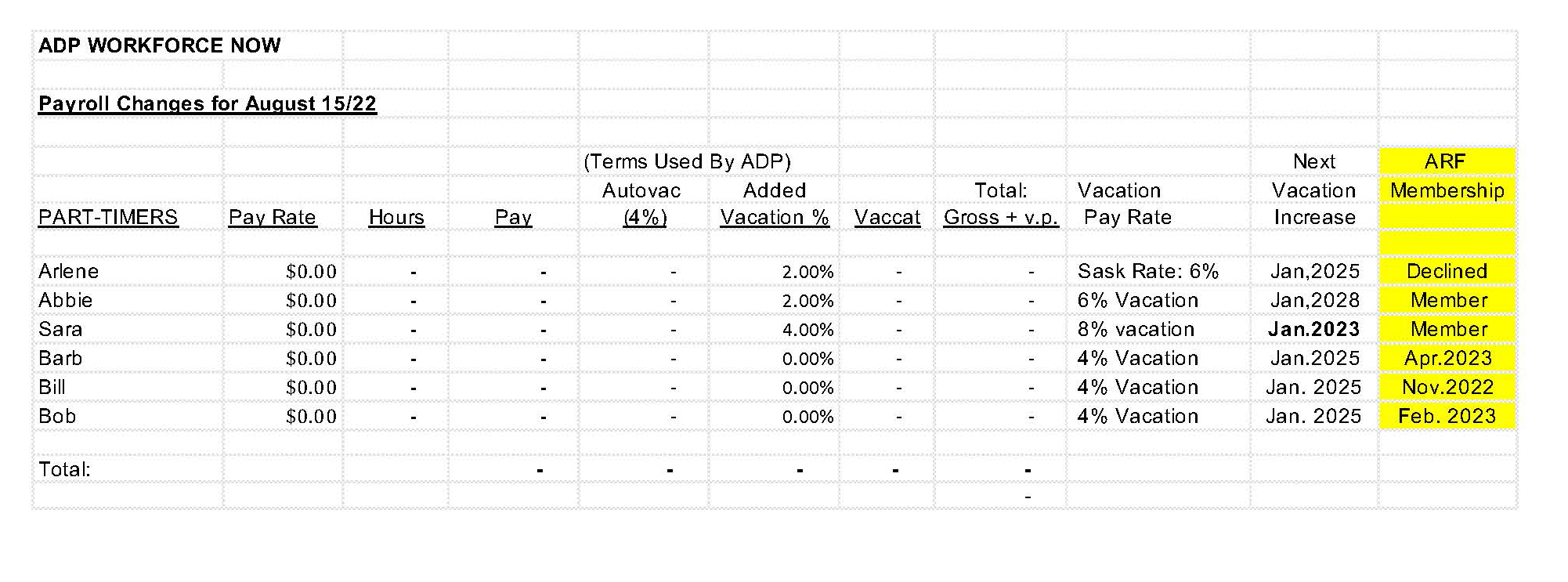

Alliance Retiral Fund

What is the Alliance Retiral Fund Pension Plan (ARF)

The ARF Pension Plan is a National plan for the Workers of The Christian and Missionary Alliance in Canada. Workers are employees who may work at any C&MA Church, School, Camp, or Day Care.

The purpose of the ARF Plan is to provide members with a convenient method of saving for retirement. Retirement income needs are also expected to come from several other resources such as government Old Age Security and Canada Pension Plan, and personal savings and investments including a home.

The ARF plan is registered under the Province of Alberta Employment Pension Plans Act because Alberta has the largest number of members. The ARF is referred to as a Registered Retirement Plan (RPP) with defined contributions.

Both the Employee and Employer participate in the plan. The current defined level is set at 5% for the Employee and the Employer matches equally with 5%.

The ARF is monitored regularly by the IAC (Investment Advisory Committee) to insure all fund managers meet our compliance standards.

Missionaries of the C&MA are cared for by the NMC under a specialized section of the ARF.

Manulife Financial

The Plan is currently with Manulife Financial - an insurance company specializing in pensions. They ensure member's funds are invested into the fund managers.

Reuters Benefits

Reuters Benefits is our consultant and retirement planners for members.

National Ministry Centre

The National Ministry Centre (NMC) of the C&MA is the administrative headquarters for the ARF Plan.

Employers

It is important for all Employers to know how the ARF works and to make sure that qualified employees do not miss out on this benefit. Here you will learn what you need to know and to do.

It is also important that your Board be aware of the requirements for ARF. Boards are often involved with hiring a new worker.

Since ARF is always connected to payroll, your bookkeeper or treasurer must be involved.

At Your Work Location You Will Have:

- Staff who are members the ARF plan

- Staff who may not be members of the ARF plan

- Staff who may be leaving

The ARF is often referred to as a “benefit” like “health benefits” are. Sometimes there is confusion with the word “benefit”. While both are benefits, they are separate with each having their own rules. For example, health benefits may have a waiting period to join.

The ARF is a National plan, it is not a District plan. Some Districts have a Health Benefits program.

Review Your Staff:

- Do we have any Permanent Full-time or Permanent Part-time workers on staff who are not on the ARF plan and why?

- Is your staff aware of how voluntary contributions work if they would like to participate?

Important Must-Knows:

- Full-Time Permanent Employees are required to join immediately as a condition of employment with the C&MA.

- The monthly Contribution Remittances must reach the NMC within 30 days of the end of the month in which the deductions were made. For example, deductions from an employee’s pay made in the month May must reach the NMC by June 30.

This is a requirement under the Alberta Employment Pension Plans Act, the province where this Plan is registered. The Plan Administrator (NMC) is required under the same law to send a list of non-compliers to the government monthly.The reason the government is strict on this law is to protect plan members so that monthly contributions are not being held back by any employer, or the NMC. This gets members’ funds into their accounts each month for earning potential towards retirement - the whole purpose of the plan.